Zimbabwe offers a unique and compelling investment proposition for discerning investors seeking long-term value in emerging and frontier markets. Located at the heart of Southern Africa, the country combines abundant natural resources, strong human capital, and improving investment frameworks. While challenges exist, Zimbabwe presents significant opportunities for well-structured, properly appraised, and professionally managed investments.

1. Strategic Geographic Position

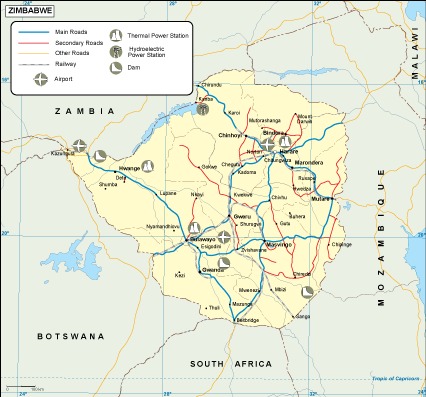

Zimbabwe’s central location in Southern Africa provides efficient access to regional and continental markets. The country is well connected through established road, rail, and air networks linking it to South Africa, Mozambique, Zambia, and Botswana. Membership in the Southern African Development Community (SADC) and the African Continental Free Trade Area (AfCFTA) allows investors to leverage preferential trade arrangements, regional supply chains, and export-oriented business models.

2. Abundant Natural Resources

Zimbabwe is one of Africa’s most resource-rich economies, with substantial reserves of:

- Platinum Group Metals (PGMs) – among the largest globally

- Gold – with both large-scale and small-scale mining potential

- Lithium – a strategic mineral critical to global energy transition

- Chrome, nickel, coal, diamonds, and iron ore

These resources present opportunities not only in extraction but also in beneficiation, processing, manufacturing, and export-focused value chains, aligning with global demand for sustainable and diversified supply sources.

3. Strong Agricultural and Agribusiness Potential

Agriculture remains a cornerstone of Zimbabwe’s economy, supported by fertile soils, diverse agro-ecological zones, and extensive water resources. Investment opportunities exist across the full value chain, including:

- Commercial crop and livestock production

- Irrigation and climate-resilient farming

- Agro-processing and food manufacturing

- Storage, logistics, and export marketing

With increasing regional demand for food security, agribusiness investments in Zimbabwe offer scalable and sustainable returns.

4. Skilled Human Capital

Zimbabwe boasts one of the highest literacy rates in Africa and a strong tradition of technical and professional education. The workforce is:

- Highly trainable and adaptable

- Cost-competitive compared to regional peers

- Experienced in mining, agriculture, manufacturing, finance, ICT, and professional services

This human capital advantage supports productivity, operational efficiency, and long-term business sustainability.

5. Investment Incentives and Regulatory Framework

The Government of Zimbabwe continues to implement reforms aimed at improving the ease of doing business and enhancing investor confidence. Key features include:

- Special Economic Zones (SEZs) offering tax incentives and customs benefits

- Duty-free importation of capital equipment for qualifying projects

- Investment protection and bilateral investment agreements

- A One-Stop Investment Services Centre to streamline licensing and approvals

These measures are designed to lower entry barriers and improve project viability when investments are properly structured.

6. Infrastructure Development and PPP Opportunities

Zimbabwe faces infrastructure gaps in power, transport, water, and urban development—creating significant opportunities for private sector participation and public-private partnerships (PPPs). Priority areas include:

- Renewable and thermal energy generation

- Transport and logistics infrastructure

- Industrial parks and logistics hubs

- Water, sanitation, and housing developments

Infrastructure investments play a critical role in unlocking broader economic growth and offer long-term, stable returns.

7. Growing Opportunities in Emerging Sectors

Beyond traditional sectors, Zimbabwe is experiencing growth in:

- Renewable energy and climate finance

- Tourism and hospitality, leveraging iconic destinations such as Victoria Falls

- Financial services, fintech, and digital platforms

- Real estate and mixed-use developments

- ICT and innovation-driven enterprises

These sectors present diversification opportunities for investors seeking balanced portfolios.

8. Undervalued Market with First-Mover Advantages

Zimbabwe remains relatively undercapitalised compared to its resource base and economic potential. This creates:

- Attractive entry valuations

- Opportunities for strategic partnerships

- First-mover advantages in emerging industries

Investors who undertake thorough investment appraisal, risk assessment, and structuring are well positioned to benefit from future economic stabilization and growth.

9. Risk Awareness and Informed Investment

Zimbabwe’s investment environment requires careful consideration of macroeconomic, regulatory, and operational risks. Successful investment outcomes depend on:

- Robust feasibility studies

- Financial modelling and sensitivity analysis

- Regulatory and policy risk assessment

- Strong governance and compliance structures

Informed decision-making is essential to mitigating risk and enhancing returns.

10. ARC Financial Advisory – Your Strategic Partner

At ARC Financial Advisory, we provide independent, professional advisory services to support investors throughout the investment lifecycle. Our services include:

- Investment appraisals and feasibility studies

- Financial modelling and valuation

- Market entry and structuring advice

- Risk analysis and mitigation strategies

- Transaction and project advisory

Our deep understanding of Zimbabwe’s economic landscape enables us to help investors navigate complexity, structure bankable projects, and achieve sustainable investment outcomes.